How FIFO vs LIFO Can Skew a Company's Profits: A Guide for Stock Investors

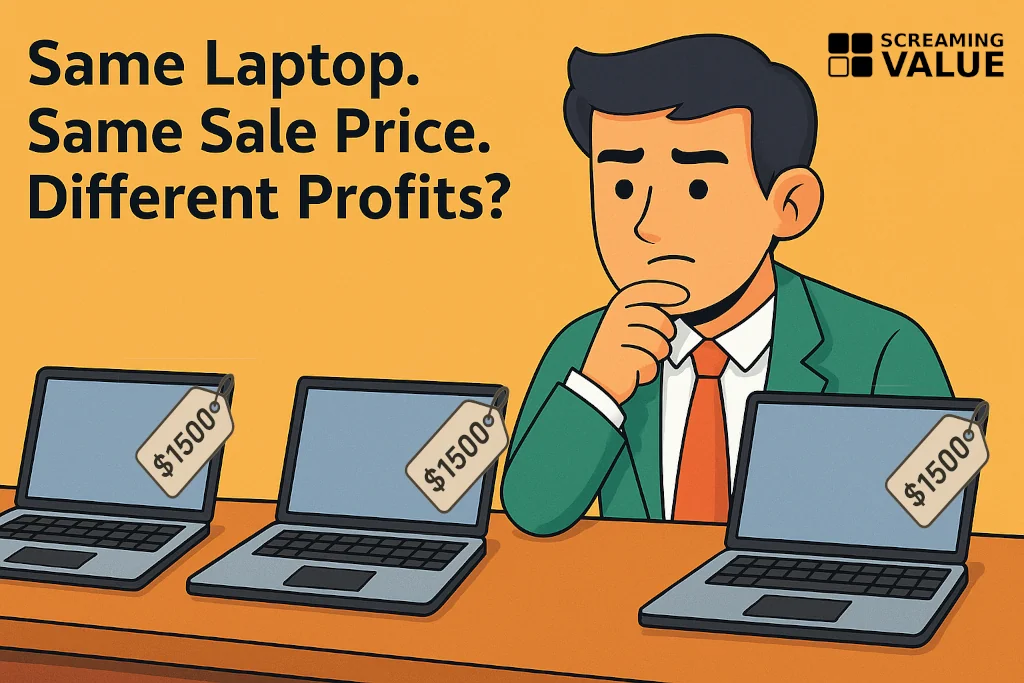

Imagine you're analyzing a consumer electronics company as an investor. You notice the company buys laptops for resale, but wholesale prices fluctuate. One month, a laptop costs $1,000. The next, it's $1,200. When the company sells a laptop, how do they decide how much that unit "cost them" from an accounting standpoint?

The inventory costing method—FIFO, LIFO, or weighted average cost—can significantly affect reported profit margins, taxable income, and balance sheet inventory values. These differences directly impact how you interpret a company's financial health and performance.

Let's walk through these methods using a simple, real-world example.